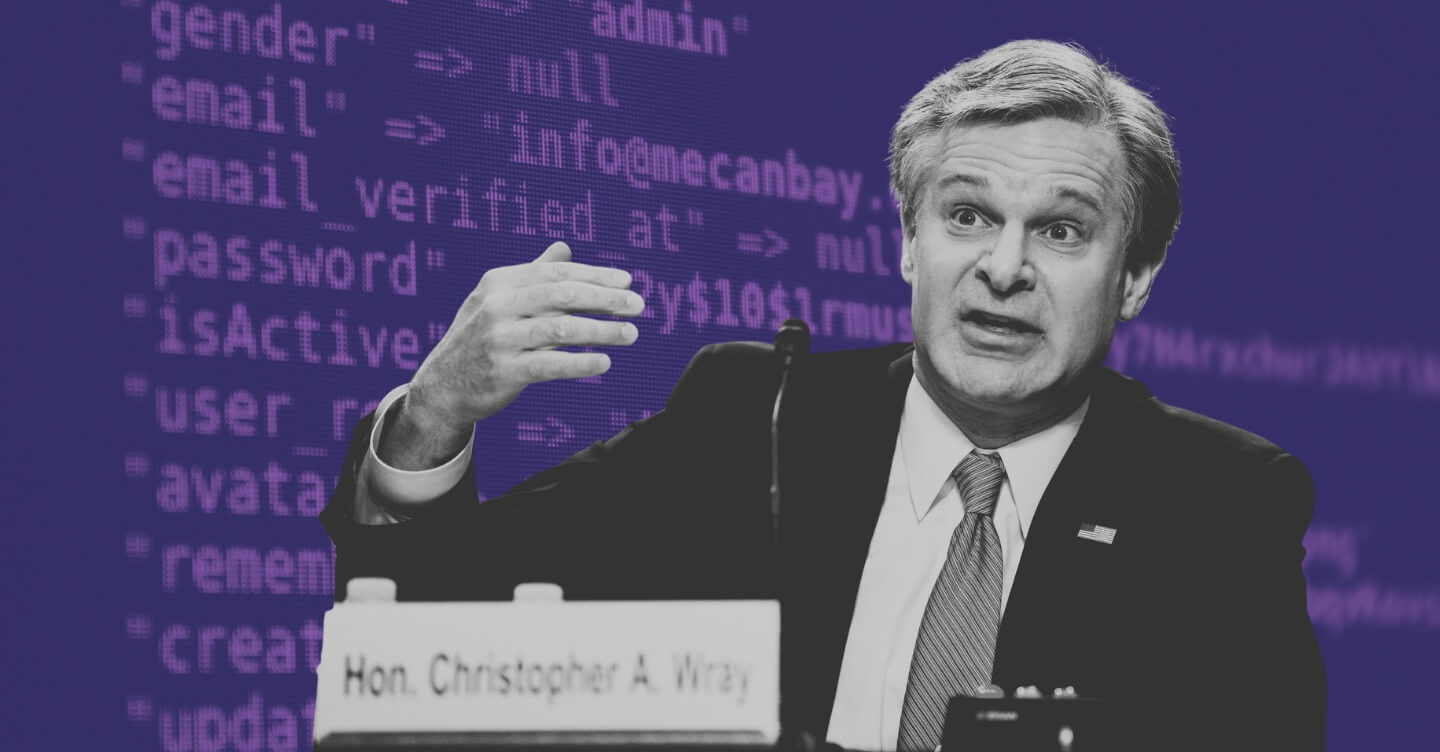

In a startling admission that strikes at the very heart of American civil liberties, FBI Director Christopher Wray confessed to the regular acquisition of innocent Americans’ personal data from companies with the prospect of potential criminal charges. This disconcerting confession has reignited concerns about the politicization of the nation’s principal federal law enforcement agency and its potential weaponization against the very people it’s sworn to protect.

The startling admission occurred during a House Judiciary Committee oversight hearing and substantiates the testimony of an FBI whistleblower, George Hill. Hill, a former supervisory intelligence analyst with the FBI’s Boston field office, had previously alleged that Bank of America voluntarily surrendered a significant volume of financial records to the FBI. This data pertained to customers who had used the bank’s credit or debit cards in the vicinity of Washington D.C. around the time of the Jan. 6, 2021, Capitol riot.

When queried by Republican Rep. Thomas Massie about the bank providing the FBI with gun purchase records without legal process or geographical constraints, Wray stated, “A number of business community partners all the time, including financial institutions, share information with us about possible criminal activity, and my understanding is that that’s fully lawful.”

In other words, your personal financial transactions, particularly those related to firearms, could be shared with the FBI without your knowledge or consent. While Wray insisted this information was “shared with field offices for information only,” he confirmed that the data was used as a basis for initiating potential criminal investigations.

Despite Wray’s claim that such a process is “fully lawful,” Massie expressed doubt, challenging the director about the absence of a warrant. Wray responded, “Again, my understanding is that the institution in question shared information with us, as happens all the time.”

This dialog reveals a disconcerting gap in the protection of citizens’ privacy. The balance between ensuring national security and maintaining individual privacy seems to be shifting alarmingly towards the former, with agencies like the FBI obtaining personal information without explicit legal process.

It’s a precarious situation. One might argue that the security of the nation necessitates such steps. Still, we can’t ignore the creeping dread that the systems and institutions we trust to uphold our rights are beginning to encroach upon them. The line between vigilance and violation of rights seems to be blurring.

Massie encapsulated this sentiment perfectly in his response to Wray’s defense of the FBI’s actions: “It may be lawful, but it’s not constitutional.”

These revelations echo George Orwell’s chilling prophecy in ‘1984’: “Big Brother is watching you.” While the FBI’s admission may have some feeling like they’re walking into the pages of this dystopian novel, the controversy underscores the urgent need for a transparent, accountable, and, above all, constitutional process to protect personal data.

As we grapple with this disturbing revelation, the call for decentralized banking and a move towards a more private, secure financial system becomes louder. The traditional banking system’s complicity in sharing personal data without warrants underscores the importance of financial systems that prioritize user privacy and uphold democratic values.

While it may be premature to herald the downfall of traditional banking, these developments undoubtedly underscore the growing appeal of decentralized finance. As we stride further into the digital age, we must strive to ensure that our rights and freedoms stride with us, rather than being left behind in a cloud of data and digits.

Leave a Reply